The Rise and Reckoning of Ticketmaster: A Tale of Monopoly and Scandal

by Cindy Harper | May 30, 2024

Few acts are as openly monopolistically brazen as the saga of Live Nation and Ticketmaster. Not only did the 2010 merger between the two live event ticketing companies create a behemoth but it was also rubber-stamped in the shadow of alleged corruption. Rahm Emanuel, President Obama’s chief of staff, whose brother, Ari Emanuel the founder of Endeavor (which owns both UFC and WWE) just so happened to serve on the board of the newly minted corporate monstrosity. This cozy familial arrangement set the stage for what would become a catastrophic antitrust record for the Obama administration’s first term.

The Ticketmaster monopoly saga began in the 1990s with a merger that went unchallenged. In 1991, Ticketmaster acquired its main rival, Ticketron, consolidating 90% of the ticketing business under one roof.

By 1994, Ticketmaster’s exorbitant fees had sparked a rebellion from none other than Pearl Jam, then the biggest band in the world. Outraged by the high prices and hidden fees imposed on their fans, Pearl Jam sought to charge a modest $1.80 service fee on $18 tickets, a far cry from Ticketmaster’s gouging. When Ticketmaster refused, the band boycotted the ticketing giant, testifying before Congress and launching a lobbying campaign to highlight the firm’s acquisitions and shady tactics.

Ticketmaster retaliated by essentially blacklisting Pearl Jam, bribing venues to exclusively use Ticketmaster’s booking system. This forced the band to perform in makeshift venues like sports fields, leading to a disastrous 1995 tour. Pearl Jam’s campaign against the monopoly, while noble, ended in financial ruin for the band – a poignant moment that underscored the unchecked power of monopolistic corporations.

As the years went by, Ticketmaster grew unchecked, swallowing up rivals and tightening its grip on the market. Enter Live Nation, another industry powerhouse that had rolled up live events to become the world’s largest concert promotion company. Frustrated with paying Ticketmaster’s fees, Live Nation developed its own ticketing software and threatened direct competition. But instead of battling it out, the two giants decided to merge, ensuring that all the fees – and the accompanying outrage – stayed in-house.

Post-Merger Shenanigans

Following the merger, Live Nation wasted no time in violating its consent decree with the Antitrust Division. They jacked up fees, failed to stop ticket sales to bots, and crushed competitors like Songkick, who had developed methods to block scalpers.

And here we are, in the aftermath of decades of unchecked monopolistic practices, as the DOJ, led by Jonathan Kanter and a coalition of 30 state attorneys general, steps up to dismantle this Frankenstein’s monster of a corporation.

The New Lawsuit

Last week, Assistant Assistant Attorney General Jonathan Kanter, accompanied by a group of 29 state attorneys general (and the AG of the District of Columbia), decided it was time to dismantle the concert-industry behemoth Live Nation/Ticketmaster.

See a copy of the lawsuit below.

It’s no surprise that this case has struck a chord with the public, uniting (mostly) both sides of the political aisle. Even Merrick Garland, usually a background player at these types of events, couldn’t resist opening the press conference.

The fact that everyone hates this corporation is no secret. Anyone who has ever used either service to book tickets to a live event will know how shady the pricing and access is.

But what’s the beef, exactly? Well, the lawsuit alleges that Live Nation has been running roughshod over federal and state laws, monopolizing markets, engaging in unlawful tying, and exclusive dealing across the board – from primary ticketing services to artist promotion and venue management. The proposed solution? Break it up. Divest Ticketmaster. End the shady contracts and anti-competitive tactics.

If you’re out of the loop, Ticketmaster is widely disliked for its pricing due to several key reasons:

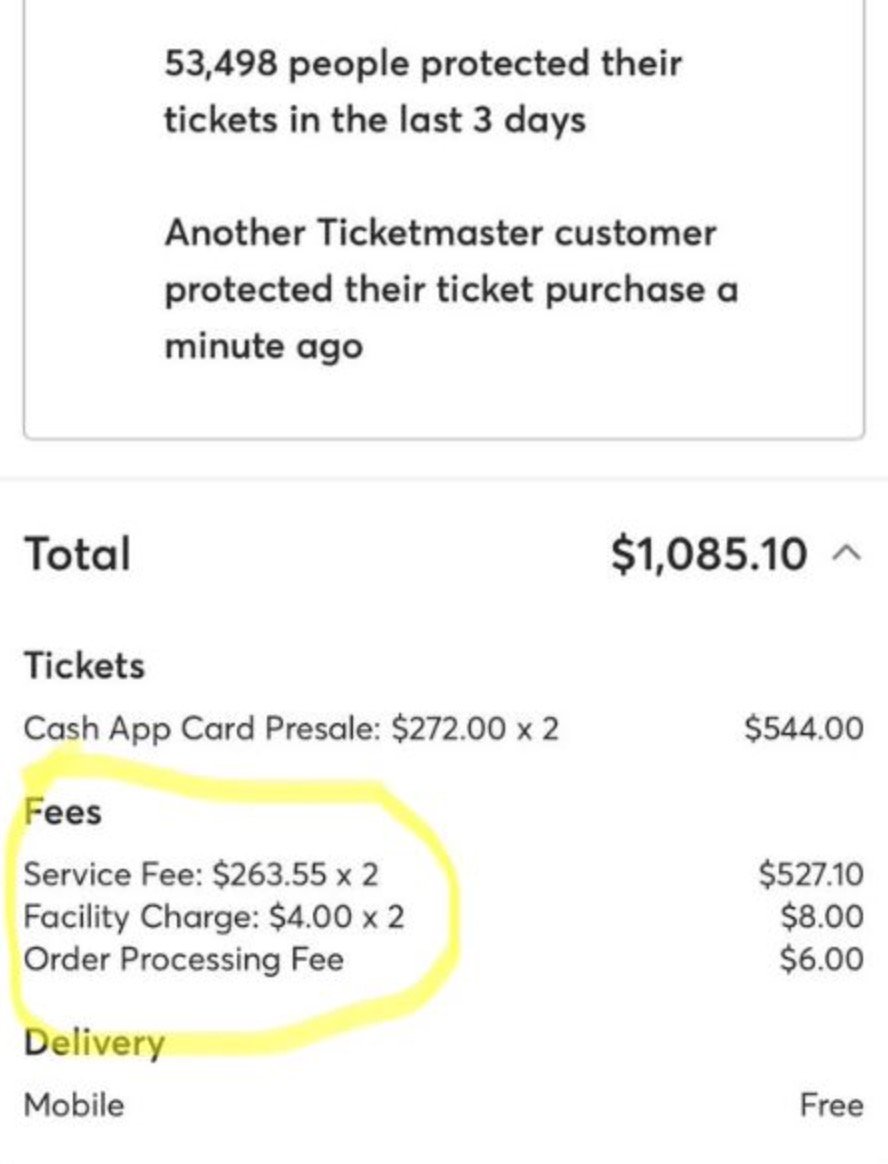

High Service Fees: Ticketmaster is notorious for adding substantial service fees to ticket prices, which can sometimes be almost as high as the ticket’s face value. These fees often come as a surprise to customers during checkout.

Dynamic Pricing: Ticketmaster uses a dynamic pricing model, which means ticket prices can fluctuate based on demand. This practice often results in significantly higher prices for popular events, causing frustration among fans.

Resale and Scalping: The platform facilitates ticket resales, where scalpers can resell tickets at exorbitant prices. This practice is seen as benefiting scalpers rather than fans, further inflating ticket costs.

Lack of Transparency: Customers often feel that Ticketmaster lacks transparency regarding the breakdown of fees and the reasons behind dynamic price changes, leading to a sense of mistrust.

Monopolistic Practices: Ticketmaster’s dominance in the ticketing industry, especially after merging with Live Nation, has led to accusations of monopolistic behavior. This dominance is perceived to reduce competition, allowing the company to impose high prices and fees without fear of losing customers.

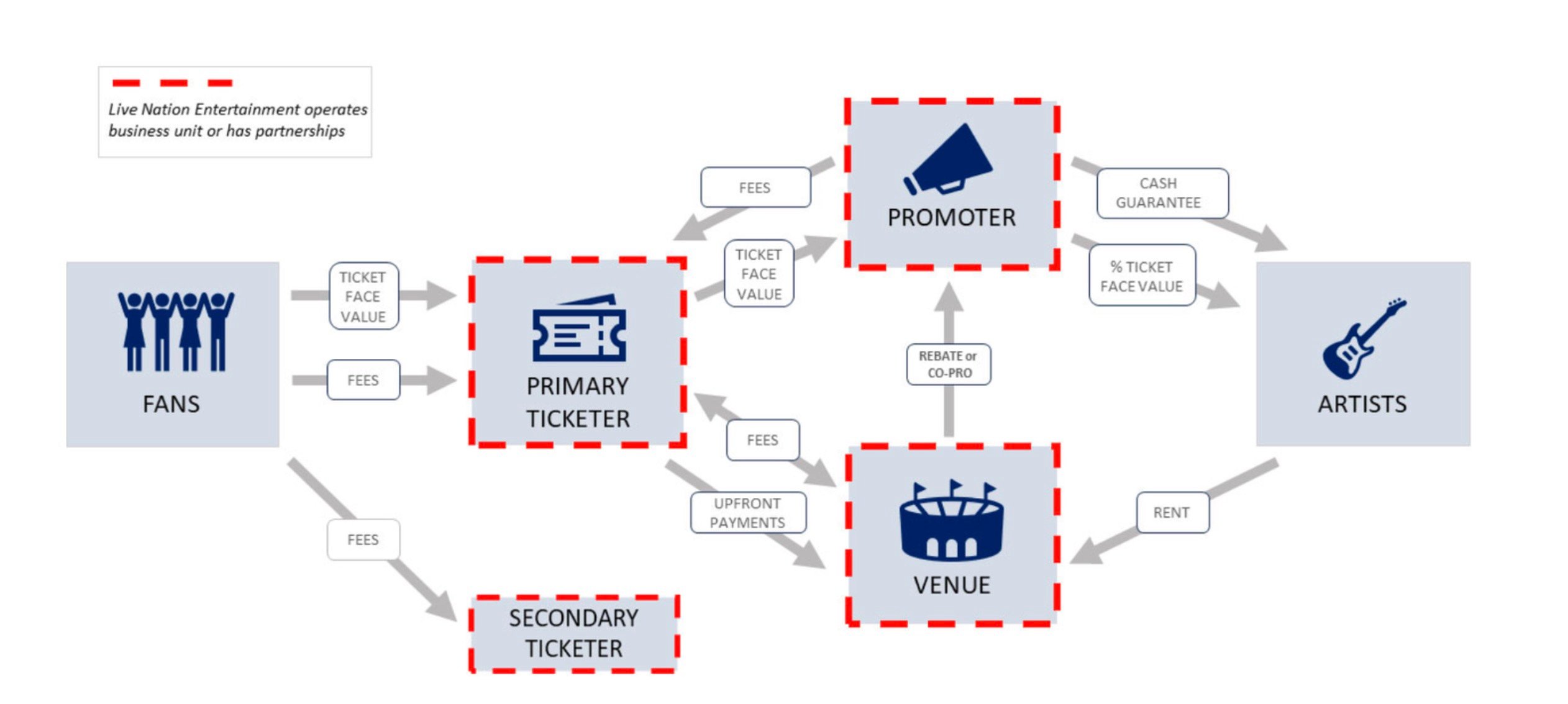

The DOJ’s complaint reads like a corporate horror story. Live Nation’s tentacles dominate various sectors of the live entertainment industry through coercion, threats, exclusive contracts, and acquisitions. The result? Artists get the short end of the stick, and consumers are slapped with the infamous “Ticketmaster Tax” – a hefty fee for the privilege of buying a ticket.

Monopoly Money

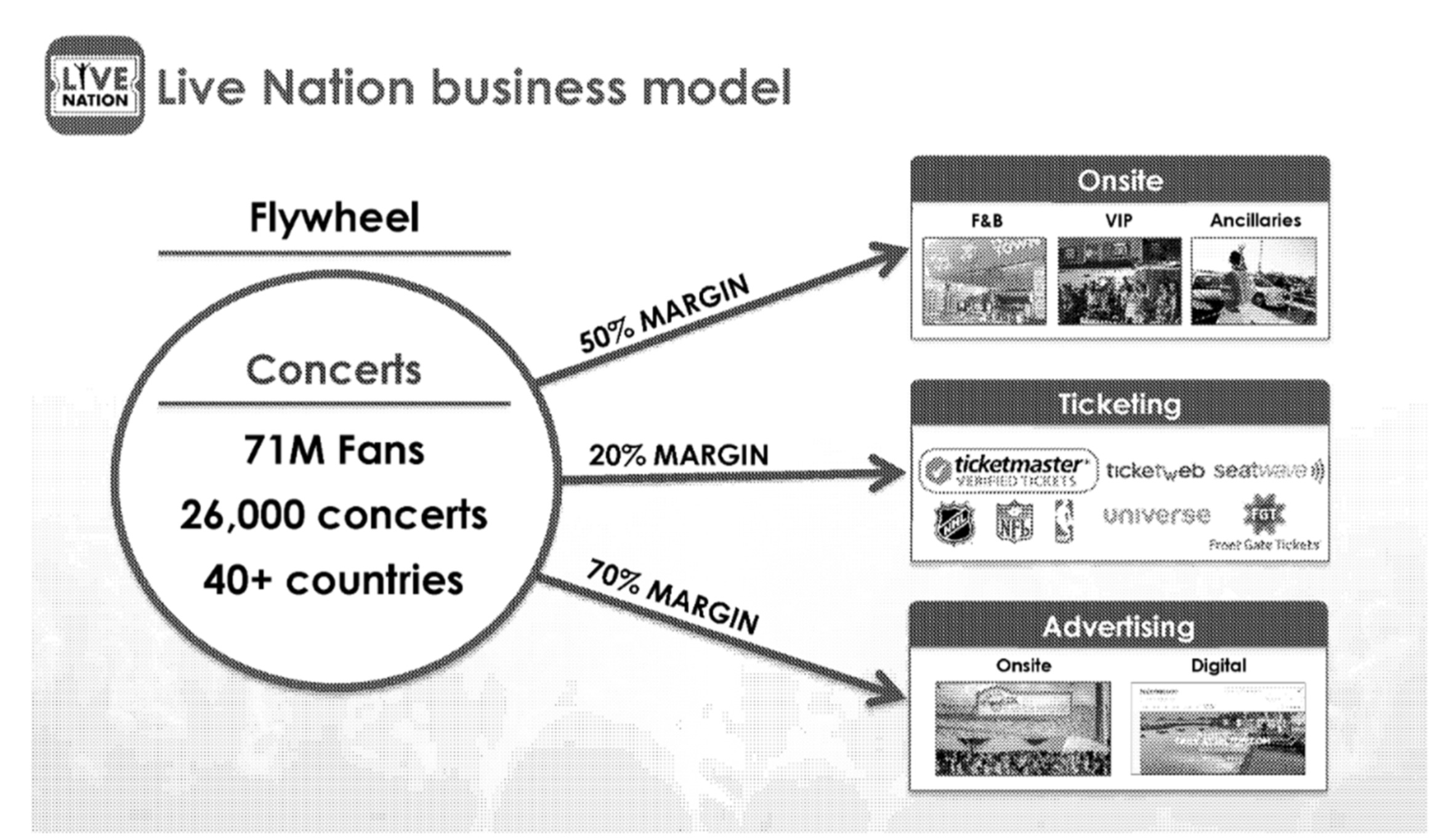

Live Nation is a four-headed hydra: ticketing (thanks to Ticketmaster), concert promotion, advertising and sponsorship, and owning/running venues. Their monopoly in ticketing is undisputed – they control more than 75% of ticket sales for major concert venues. In other countries, ticketing is a competitive market with multiple sellers, leading to lower fees and happier consumers. In the United States, Ticketmaster rules with an iron fist.

To maintain this stranglehold, Live Nation uses a familiar corporate playbook. Venues that refuse to sign exclusive deals with Ticketmaster find themselves bypassed for other venues. They’ll shift entire tours if it means preserving their ticketing revenue.

A notable example of Ticketmaster using its monopoly power occurred during the 2018 “Verified Fan” presale for Bruce Springsteen’s Broadway show, “Springsteen on Broadway.”

Springsteen on Broadway was a highly anticipated and intimate series of performances that ran from October 2017 to December 2018. Given the limited number of seats and high demand, Ticketmaster implemented its “Verified Fan” program to manage ticket sales and prevent scalping.

Issues During the Presale:

Complex Registration Process: Fans were required to register in advance to be eligible for the presale. The process was intended to filter out bots and scalpers, but many genuine fans found the system confusing and cumbersome.

Limited Ticket Availability: Despite the intention to give fans a fair chance to buy tickets, a significant number of tickets ended up on secondary market sites at inflated prices. This raised questions about the effectiveness of the “Verified Fan” program.

Dynamic Pricing: Ticketmaster used dynamic pricing for the event, leading to fluctuating prices based on demand. As a result, many tickets were sold at much higher prices than initially anticipated, making it difficult for average fans to afford them.

Resale Market Control: Ticketmaster’s own resale platform facilitated the resale of tickets at marked-up prices, allowing the company to profit from both the initial sale and the resale.

In November 2022, Ticketmaster held a presale event for Taylor Swift’s highly anticipated “The Eras Tour.” The event was intended to provide verified fans with early access to tickets. However, the process was fraught with technical issues and inefficiencies, leading to widespread frustration among fans and significant backlash against Ticketmaster.

Technical Failures: The presale event was marred by website crashes, long wait times, and numerous technical glitches. Many fans who had received presale codes and were promised early access were unable to purchase tickets.

High Demand and Dynamic Pricing: The overwhelming demand for tickets led to issues with Ticketmaster’s dynamic pricing system, which significantly increased ticket prices in real time. This practice, often referred to as “surge pricing,” resulted in tickets being sold at exorbitant prices, which many fans could not afford.

Lack of Transparency: Fans and critics accused Ticketmaster of lacking transparency regarding the availability and pricing of tickets. There were allegations that many tickets were held back for resale at higher prices, exacerbating the frustration.

The presale fiasco prompted a massive outcry from fans, who took to social media to express their anger and disappointment. Many accused Ticketmaster of exploiting its monopoly power to prioritize profits over customer experience.

Political and Legal Scrutiny: The incident drew the attention of lawmakers and regulators. Several US Senators, including Amy Klobuchar and Richard Blumenthal, called for an investigation into Ticketmaster’s practices. They raised concerns about the lack of competition in the ticketing industry and the potential for antitrust violations.

The company has also been known to use its power to harm competition. Live Nation has previously embarked on a buying spree to starve its rivals into submission. Take 2017, for instance, when Live Nation acquired United Concerts, a promoter and venue owner in Utah that dared to use a rival ticketing service, SmithsTix. Unable to outright buy SmithsTix – due to that pesky 2010 consent decree requiring DOJ notification – Live Nation opted for a workaround. They bought United Concerts and its venues, promptly converting them to Ticketmaster. Left gasping for air with just a few small clients, SmithsTix eventually went under. Classic monopolistic maneuver.

The Domino Effect of Domination

These coercive strategies allowed Live Nation to extend its tentacles into various lines of business, either by direct monopolization or through cartel arrangements. Some of these lines, like concert promotion, were low-margin, but controlling them allowed Live Nation to fortify its monopoly in the high-margin realms of sponsorship and ticketing.

Ticketmaster’s Likely Defense

So how will Ticketmaster plan to defend itself in this case? While the company has not yet formally responded to the allegations, we’ve speculated on some of the avenues it may explore.

Market Definition and Competition

One of the central defenses Ticketmaster could use is the definition of the market in which it operates. Critics often view Ticketmaster as a monopoly in the live event ticketing market. However, Ticketmaster might argue that the relevant market is broader and includes all forms of ticketing for entertainment, encompassing sports, concerts, theater, and even digital streaming events. Within this broader market, numerous competitors, including StubHub, SeatGeek, AXS, and various venue-specific and regional ticketing services, operate and offer consumers alternative options.

Barriers to Entry

Another key point in Ticketmaster’s defense could be the relatively low barriers to entry in the ticketing industry. While Ticketmaster’s extensive network and established relationships with venues and promoters are significant advantages, they do not preclude new entrants from entering the market. Technological advancements and the shift toward digital ticketing have lowered the initial investment required to start a ticketing service. Emerging companies continue to introduce innovative solutions that challenge Ticketmaster’s dominance, indicating a dynamic and competitive market environment.

Consumer Choice and Benefits

Ticketmaster might also highlight the benefits it provides to consumers and the industry as a whole. Through its platform, consumers can access a wide variety of events, often with features such as secure ticket transfer, resale options, and fraud protection. Additionally, Ticketmaster’s investments in technology, such as mobile ticketing and virtual experiences, enhance the overall customer experience. These value-added services differentiate Ticketmaster from competitors but also demonstrate the competitive pressures that drive continuous innovation.

Dynamic Pricing and Market Responsiveness

Dynamic pricing is another aspect where Ticketmaster could argue that it responds to market demands rather than controls them. The use of algorithms to set ticket prices based on demand is a practice seen in various industries, including airlines and hotels. This strategy helps maximize revenue for event organizers and can sometimes benefit consumers by lowering prices for less popular events. Ticketmaster’s role in implementing dynamic pricing could be seen as a response to market conditions rather than an exertion of monopolistic power.

Integration with Live Nation

Ticketmaster’s merger with Live Nation in 2010 intensified monopoly concerns. However, Ticketmaster might argue that the vertical integration between a ticketing service and a live event promoter creates efficiencies that benefit both consumers and artists. By streamlining operations, reducing costs, and enhancing promotional capabilities, the merger could be portrayed as a pro-competitive move that fosters growth in the live entertainment industry.

Whether Ticketmaster qualifies as a monopoly or not, the consensus is clear: almost everyone hates it. This sentiment was echoed during the lawsuit when the DOJ succinctly summarized the harms stemming from Ticketmaster’s immense power. According to the DOJ, “Fans have paid more in fees that are not transparent, not negotiable, and cannot be comparison-shopped because there are no other options; Fans have been denied access to the benefits a competitive process would deliver, such as more choices in concerts and innovative fan-friendly ticketing options; Artists have had fewer opportunities to play concerts, and fewer real choices for promoting their concerts, selling tickets to their own shows, and performing at certain venues; and Venues have fewer real choices for obtaining concerts and ticketing services, and many are reluctant to disrupt the status quo due to the financial risk.”

Subscribe to Reclaim the Net

Contact Us

Privacy Policy

Sitemap

© 2025 FM Media Enterprises, Ltd.

0 Comments