Covid has created a capitalist nightmare

by Thomas Fazi and Toby Green Feb 23, 2022

Over the past two years, as the pandemic claimed the lives of millions of people and upturned the lives of everyone else, a silent revolution was taking place. Western capitalism suddenly found itself usurped; replaced by an even more oligarchic and authoritarian capitalist mode of power — what we might call neo-feudalism. Even as restrictions are lifted in the UK and other countries, the consequences of these changes will be felt for a long time to come.

On the one hand, hundreds of thousands of small and medium businesses were forced to shut down, triggering one of the worst jobs crises since the Great Depression. In 2020 alone, workers around the world cumulatively lost $3.7 trillion in earnings — an 8.3% decline.

On the other, a handful of mega-corporations, particularly in the Big Tech and Big Pharma sectors, have made a killing, raking in hundreds of billions more in “pandemic super-profits” than over the previous four-year average. Topping the list are behemoths such as Amazon, Apple, Microsoft, Alphabet (Google), Facebook, Pfizer, Johnson & Johnson, AstraZeneca and Merck.

The success of the Tech giants — Amazon, Apple, Microsoft, Alphabet, Facebook — is easily explained. As people found themselves confined to their homes, they turned to the internet for pretty much everything: shopping, dining, working, schooling, entertainment, socialising, even sex. In other words, what represented a curse for countless small and medium traditional businesses, represented a blessing for a handful of corporate behemoths.

The golden egg for the pharmaceutical companies, however, came later with the vaccines: the companies behind two of the most successful Covid-19 vaccines — Pfizer, BioNTech and Moderna — made combined profits of $34 billion in 2021. And if the “new normal” ends up including permanent booster shots, such super-profits will become the norm. Crucially, these profits are then distributed to shareholders who predominantly belong to the richest 1% of society. It’s hardly surprising then that billionaires around the world saw their wealth increase by $3.9 trillion just in 2020. As Oxfam starkly put it in a recent report: “The wealth of the 10 richest men has doubled, while the incomes of 99% of humanity are worse off”.

To see what this means in practice, one need only turn to Latin America, whose billionaires increased their wealth by 52% during the pandemic. In Mexico, meanwhile, multimillionaires saw their wealth increase by 31.4% in 2021 alone. On the other hand, over the last two years, 78 million people in the region were plunged into extreme poverty, while 13% of children abandoned education altogether.

In Africa, where low-income countries predominate, the picture is equally stark. A report this month noted that not only had GDP fallen by as much as 7.8% in some cases, but that remittances from abroad had fallen by 25%. In a context where remittances from rich countries accounted for over half of private capital flows to Africa shortly prior to the pandemic, this has had a devastating effect on the daily economy, with over 40 million additional people in extreme poverty.

Couple this with a debt crisis, and it is not surprising that the impact on daily lives has been devastating: in Angola, a recent report described how youth unemployment doubled to nearly 60% in the past two years. Meanwhile, the continent’s billionaires have seen an uptick in their fortunes, as elsewhere; a January report from Nigeria found that Africa’s 18 billionaires had seen their wealth increase by 15% in 2021 alone.

Yet in many ways this is a global phenomenon; on every continent, there has been a hyper-concentration of wealth, and poorer communities have suffered. Wealth has been further racialised, with minority communities suffering the most in rich countries, and poorer continents the worst affected.

Why, then, have Left-leaning commentators supported the policies that have led to these terrible outcomes?

The usual explanation is that these impacts were an inevitable impact of the pandemic. And yet the evidence for this is weak, not least because most of those affected by the virus have been elderly people often beyond an age of active employment. In Africa, a 1% increase in mortality from Covid in a country like Nigeria cannot explain the 20% collapse in formal employment. In fact, Tanzania — one of the very few countries that did not impose Covid restrictions in 2020 — was also almost the only country in Africa to see its GDP increase, by as much as 5% according to some reports. Meanwhile in Sweden, where restrictions were much milder than in the rest of Europe, the country returned to pre-pandemic levels of production by the middle of 2021, in contrast to many other European countries (while registering lower per capita mortality rates than many other countries).

And so it seems that the staggering increase in inequality, and in the concentration of capital, must be the consequence of the Covid response measures, not of Covid-19. What, then, are some of the likely consequences of this massive accumulation of capital by a tiny number of people, expropriated from SME owners and the global working class?

A dystopian future seems to be emerging from the ashes of the pandemic — one in which not only is wealth more concentrated than ever in the hands of a small elite, but in which practically every sector of the economy is dominated by a handful of all-powerful mega-corporations. Perhaps it’s unsurprising, then, that those who have most profited from the pandemic response, such as Bill Gates and Mark Zuckerberg, also supported that response and removed information from their portals which criticised it.

However, there’s a further element that makes this scenario even more disturbing, if possible, and that is the growing consolidation not only within, but also between, sectors. This becomes evident when we look at the investment funds that actually “own” these corporations. BlackRock and Vanguard are the two largest asset management firms in the world, respectively managing $10 and $8 trillion. That’s 3.7 and 3 times more than the UK’s annual GDP. These two funds are the top “owners” of all the major Big Pharma (Pfizer, Johnson & Johnson, Merck), Big Tech (Facebook, Twitter) and Big Media (New York Times, Time Warner, Comcast, Disney, News Corp) corporations. Even more worrying is the fact that despite having shareholdings of “only” 5-7% in these companies, there is growing evidence that institutional investors such as BlackRock and Vanguard try to influence company management and boards on strategy.

It would appear that these funds also coordinate among themselves. When analysing the voting behaviour in board meetings of the two funds, researchers found that they coordinate it through centralised corporate governance departments. This is hardly surprising if we consider that BlackRock and Vanguard are also each other’s main institutional investors: in other words, they partially “own” each other through cross-shareholding. So, we are effectively in the presence of a single super-entity that “owns” and controls a huge chunk of the Western economy. While this was already the case before the pandemic, the latter has accelerated this trend. More importantly, it has brought to the surface the way in which these funds, through their cross-sector corporate control, can “harmonise” these companies’ behaviour to further their interests.

We can see this in the case of debate around pandemic strategies on social media, and the censorship exercised today by social media platforms against any critical voice, no matter how qualified. A good example might be the removal from YouTube of a video of a senior editor of the British Medical Journal, Peter Doshi, discussing the Pfizer Covid vaccine trial in a US Senate hearing — in which among other things Doshi had questioned the accuracy of the reporting of the Pfizer vaccine effectiveness.

This is worrying in itself. But it becomes even more worrying when we consider that the companies selling the vaccine, the media outlets shaping the mainstream vaccine narrative and the social media platforms enforcing that narrative are, to a large degree, “owned” and controlled by the same two funds: BlackRock and Vanguard, which, incidentally, are raking in billions from the vaccines. This harmonisation among sectors (and between the latter and governments) points to the rise of a new ultra-powerful complex — the techno-media-pharma (TMP) complex. This is evident in increased “synergies” between these sectors: take Google’s growing investments in the health, pharmaceutical and pandemic-prevention sectors, for example, or Amazon’s investment in Covid-19 research.

Of course, none of this would be possible without the active support of governments, which create an enabling environment that rewards participants in the TMP complex. This is evident, for example, in the secrecy, overpricing, cronyism, and inefficiency that has characterised Covid procurement deals: Covid tests, PPE, vaccines, and now vaccine passport technologies have all been parcelled out to transnational corporations without proper tendering processes or legislative oversight. In other words, this is not a scenario in which governments disappear, but rather one that relies on increasingly powerful and authoritarian state apparatuses furthering the interests of big capital.

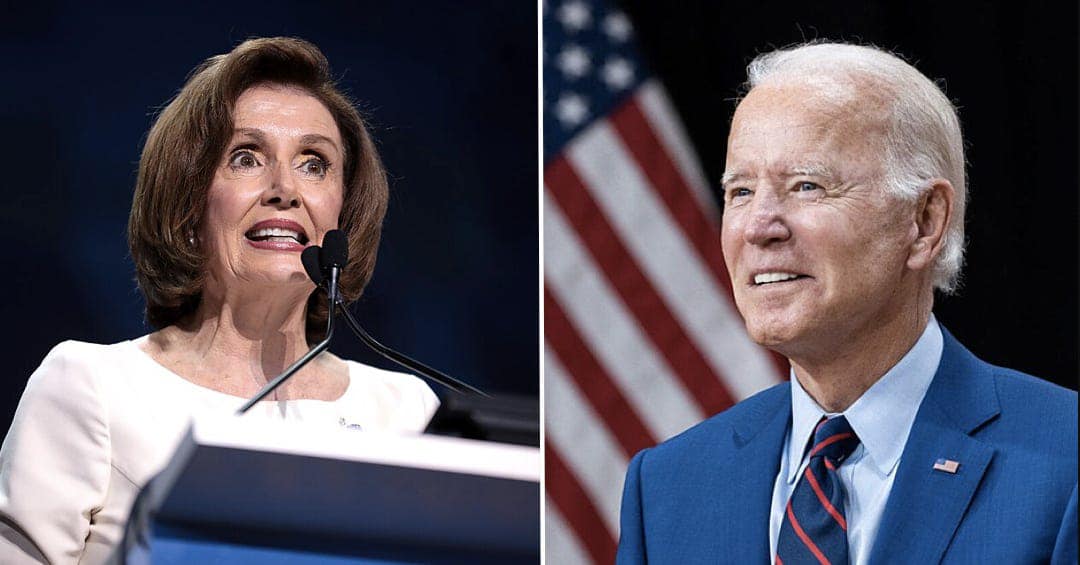

This is hardly surprising when we consider the extent to which these corporate giants have meshed with our political systems. The US is a good case in point. Obama was very close to Eric Schmidt, CEO of Google, who later became a close collaborator of the Pentagon in developing military applications of AI. Today, Biden’s economic policies are heavily influenced by the director of the National Economic Council, Brian Deese, a former BlackRock executive. This ultra-elite is now in a position to shape every aspect of our lives — and it’s frankly terrifying.

If the Left is to recover from the catastrophic policies that it has supported during the pandemic, it must begin by recognising that it is lazy and misplaced to denounce those who point out these inconvenient truths: that wealth is hyper-concentrated as never before, that this is as a result of the policy choices during the pandemic, that these choices were unprecedented, and have been supported by those who enriched themselves enormously along the way, and censored any alternative point of view.

If we don’t want a world dominated by a very few ultra-wealthy people, and their vision for retaining that wealth, an unprecedented collective effort will be needed to fight for a different future. The huge TMP conglomerates will have to be broken up and their profits used for the benefit of all humanity, and not just their shareholders. This will be the struggle against the post-pandemic capitalist nightmare — and we are already losing.

0 Comments