“Putin’s hiking prices right now, from under this lectern!”

Blue and Red Do Have Something in Common. They’ve Both Been Ripped Off, Repeatedly

by Matt Taibbi | Jun 22, 2022

Good, honest, hardworking people, white collar, blue collar. Doesn’t matter what color shirt you have on… People of modest means continue to elect these rich cocksuckers who don’t give a fuck about them. They don’t give a fuck about you. They don’t give a fuck about you… It’s called the American dream because you have to be asleep to believe it.— George Carlin

On June 14th, in Philadelphia, President Joe Biden gave a speech before leaders of the AFL-CIO. This is the role Joe Biden was hired to play, the hardscrabble “Scranton Joe” persona who gets the common working person. He addressed an issue very much on the minds of ordinary folk:

I’m doing everything in my power to blunt Putin’s gas price hike. Just since he invaded Ukraine, it’s gone up $1.74 a gallon — because of nothing else but that.

This followed remarks he’d made in Los Angeles a week before, at the 9th Summit of the Americas:

The COVID-19 pandemic hit our region particularly hard… Twenty-two million more people fell into poverty in just the first year of the pandemic. Inequity continues to rise. Global [inflationary] pressures… made worse by Putin’s brutal and unprovoked war against Ukraine… are making it harder for families to make ends meet.

Watching Biden on the stump these days is heartbreaking. He combines Ron Burgundy-style slapstick teleprompter-dependence (one half expects him to end a speech soon with “Go fuck yourself, San Diego”) with the terror of a man who can see the bright light coming. Both effects are worsened by the fact that he’s peddling an insane, indefensible lie. i.e. that America is suffering through “Putin price hikes,” and not the inevitable consequence of yet another transparent state-aided ripoff scheme to soak the middle and lower classes on behalf of the 1%.

Possibly Biden’s people have secret polling showing that the public will buy the gambit, but the blunt truth is the rent is just coming due on years of Fed-fueled partying, and officials know it. They’ve repeatedly tried to lie anyway. As far back as last May, Biden’s Treasury Secretary, former Fed chief Janet Yellen, was reassuring the public that “I really doubt that we’re going to see an inflationary cycle,” and though “we expect somewhat higher inflation over the next several months,” this would be for “essentially technical reasons,” and “a transitory thing”:

Both Yellen and Fed chief Jay Powell kept insisting that inflation was “transitory.” Then, just a few weeks ago Yellen, in an interview that in a darkly humorous way recalled Alan Greenspan’s infamous “I’ve found a flaw” testimony about his belief that the self-correcting market should have stopped the mortgage manias before 2008, conceded to a feisty Wolf Blitzer that “I think I was wrong” to downplay the risk of inflation. Of course, Yellen immediately shifted to the “Putin price hike” excuse, blaming “unanticipated… shocks” in energy and food prices for America’s troubles.

Even CNN, whose reporters would normally buy ice in Alaska from a Biden official, wasn’t convinced. A “CNN Fact-check” on the administration’s inflation line pointed out that “America’s inflationary surge started in May of 2020, while Trump was still in office, and has skyrocketed under Biden.” Even former Barack Obama advisor Steven Rattner shat on the “Putinflation” theory back in March, tweeting, “Well, no. These are Feb #’s and only include small Russia effect. This is Biden’s inflation and he needs to own it.”

The last two years are really just the same old rehashed bubble economics heist narrative. A gang of insiders talks up a new asset class, and aided by a titillating infusion of institutional money and/or Federal Reserve largess, the public is enticed to jump in, perhaps also inspired by the stick of punitive savings rates. This time around, in place of Alan Greenspan telling people to hop into the counter-intuitive “new paradigm” of growth without inflation (during the Internet bubble), or recommending people use their home equity savings as ATM machines (in the heat of the wealth-eating mortgage Ponzi), we saw the Yellens and Powells of the world telling us inflation was “transitory.” Come on in, the water’s great! And jump in people did.

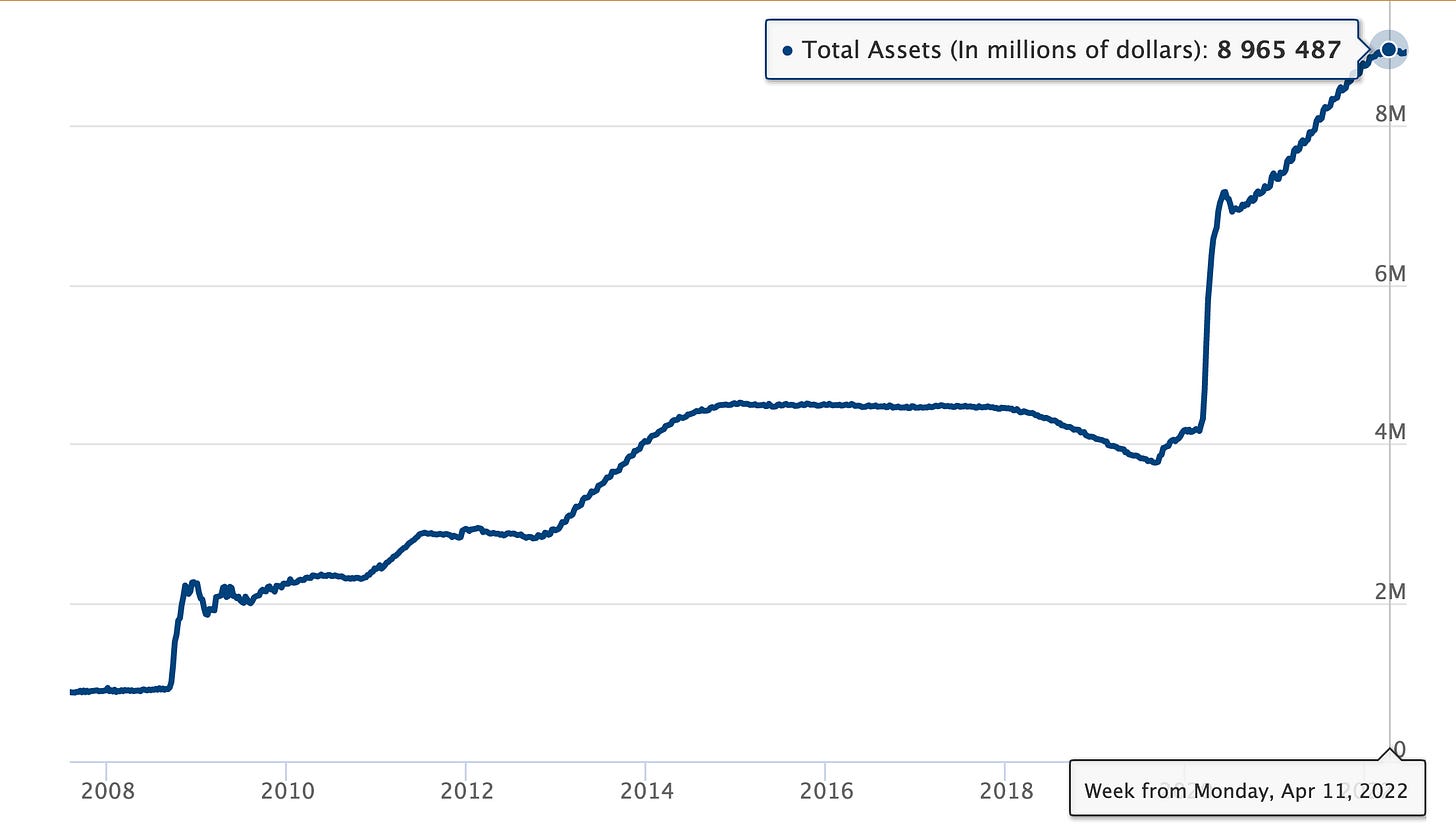

What really happened: at the start of the pandemic, on March 2, 2020, the Federal Reserve owned about $4.24 trillion in assets. After the passage of the bipartisan CARES Act and several subsequent COVID relief packages backed by both parties (one signed by Trump, another by Biden), the Fed went on an unprecedented buying spree. Their balance sheet reached a peak of about $8.96 trillion in assets in April of this year, before beginning a slight downward descent. That means the Fed dumped roughly $4.7 trillion in printed money into the economy in the last two years, creating the illusion of a boom:

Where did that $4.7 trillion go? Virtually across the economic spectrum, we watched people at the top of the income distribution magically achieve personal net worth increases that bore eerie resemblances to the near-doubling of the size of the Fed’s holdings. Where to start? Just taking America’s 727 billionaires, they went from collectively being worth $2.947 trillion in March of 2020 to being worth $4.657 trillion in May of this year, a gain of $1.7 trillion. Another study showed billionaires went from owning 1% of the world’s wealth in 1995, to 3.5% by last year.

Every business that depends upon easy borrowing made fortunes during the pandemic years. The private equity business, which uses borrowed money to finance takeovers and mergers, had a record year in 2021, doing just shy of $1 trillion in deals in 2021 ($987.6 billion). This nearly doubled the industry’s also-awesome $474.5 billion in 2020 deals. There is no chance so many PE firms could have made so much taking over so many companies (resulting in job losses at firms like PetSmart and even some hospitals and emergency rooms society needed during the pandemic) without this extraordinarily loose credit environment.

Bailout servicers also made out. Banks reported a record $297 billion in profits in 2021, following a 2020 that saw those same institutions smash records for underwriting fees, a direct consequence of underwriting vast amounts of bailout lending in the form of bond issues. Bank after major bank in 2020 and 2021 either reported doing record business, or having their best years since 2009, which by an extraordinary coincidence happened to be the last time the Fed and the Treasury flooded the system with rescue cash.

After two years of doing mind-boggling business during a period when the national economy was essentially on hold, nobody thinks it’s weird now that bankers are now telling us to brace for a recession just as the economy is opening up and growing again.

Lloyd Blankfein, whose former bank Goldman, Sachs had its best run of profits since 2009 in the first pandemic year, just a few weeks ago warned that global recession is “definitely a risk” if not “baked in the cake” yet. J.P. Morgan Chase chief Jamie Dimon, who saw a raise to $34 million in 2021 after his firm set a profit record (despite a 14% drop in the 4th quarter), warned of “storm clouds” ahead earlier this year, if the Fed reversed its buying program. (Such stories, in which chin-scratching business leaders warn of disaster ahead if the Fed stops handing them risk-free billions, have become a dependable news genre).

Everyone did well in 2020 and 2021, despite global commerce grinding to a near halt. The cryptocurrency market briefly surpassed $3 trillion last year, with some saying crypto attracted investment by assuming the role of “digital gold,” although as one industry writer put it to me, “There was a get-rich-quick thing going on there.” Sotheby’s and Christie’s rode the crypto wave and cheerfully sold digital art in the form of non-fungible tokens (NFTs) for tens of millions of dollars, with CryptoPunk’s “Covid Alien” selling for $11.7 million. while “HUMAN ONE” by the crypto artist Beeple sold for $29.7 million. Of course I’m no one to say this was a bad deal, and I get the idea of Blockchain-identified NFTs mimicking the unique financial properties of art, but from one angle this modern Van Gogh looks a lot like a Tweet that struggled to get 6,000 likes:

All this partying took place before disasters like the crash of the TerraUSD stablecoin and, more recently, the crypto lending platform Celsius announcing a freeze of all withdrawals, after which the total crypto market was down below a trillion. I happen to be a believer in the revolutionary potential of Blockchain technology, but bad actors can crack any market with the right rap, and the recent developments mean someone, or a bunch of someones, suffered nearly $2 trillion in losses in a very short time. Who got out, and who took a beating?

One hint lay in the fact that executives all over spent as much cash as they could on stock buybacks during the pandemic years. When companies buy back their own stock, they retire the shares, raising the stock’s value overall. The maneuver pays off top shareholders, who again by extraordinary coincidence are often the very executives approving the buybacks, while investing vast sums not in growing the firm or creating jobs, but in increasing the worth of the stock shares often used as compensation. During the pandemic, we had example after example of firms rushing into buyback plans the instant they got splashed by the COVID cash waterfall.

Defense contractors for instance got a special dispensation from the government at the outset of COVID, granted $4.6 billion in an “accelerated payment program” that gave firms like Lockheed-Martin credit for outstanding contracts even if they hadn’t been fulfilled. The industry responded by taking that $4.6 billion in cash and repurchasing $4.8 billion of its own stock just in that quarter, more than the entire previous year. It wasn’t until this year that the Pentagon decided to “weigh” whether or not to suspend the accelerated payments, which by early this year reached $5.3 billion just for the so-called “top-5” contractors: Lockheed Martin, Boeing, Raytheon, Northrop Grumman, and General Dynamics.

Overall, S&P companies repurchased a record $234.5 billion in stock in the third quarter of 2021, and this was after a record $2 trillion buyback binge in the three years preceding the pandemic. The orgy of buybacks was one of many factors fueling the stock rally of the last few years, and as the Wall Street Journal put it, “Asset prices have continued to benefit from the monetary and fiscal support that policy makers put in place to help the economy get through the pandemic.” The paper added last December that investors would “scrutinize signals out of the Federal Reserve… where officials may accelerate the process of winding down a bond-buying stimulus program.” Translation: the more money the Fed poured into the market, the more companies took out in the form of buybacks.

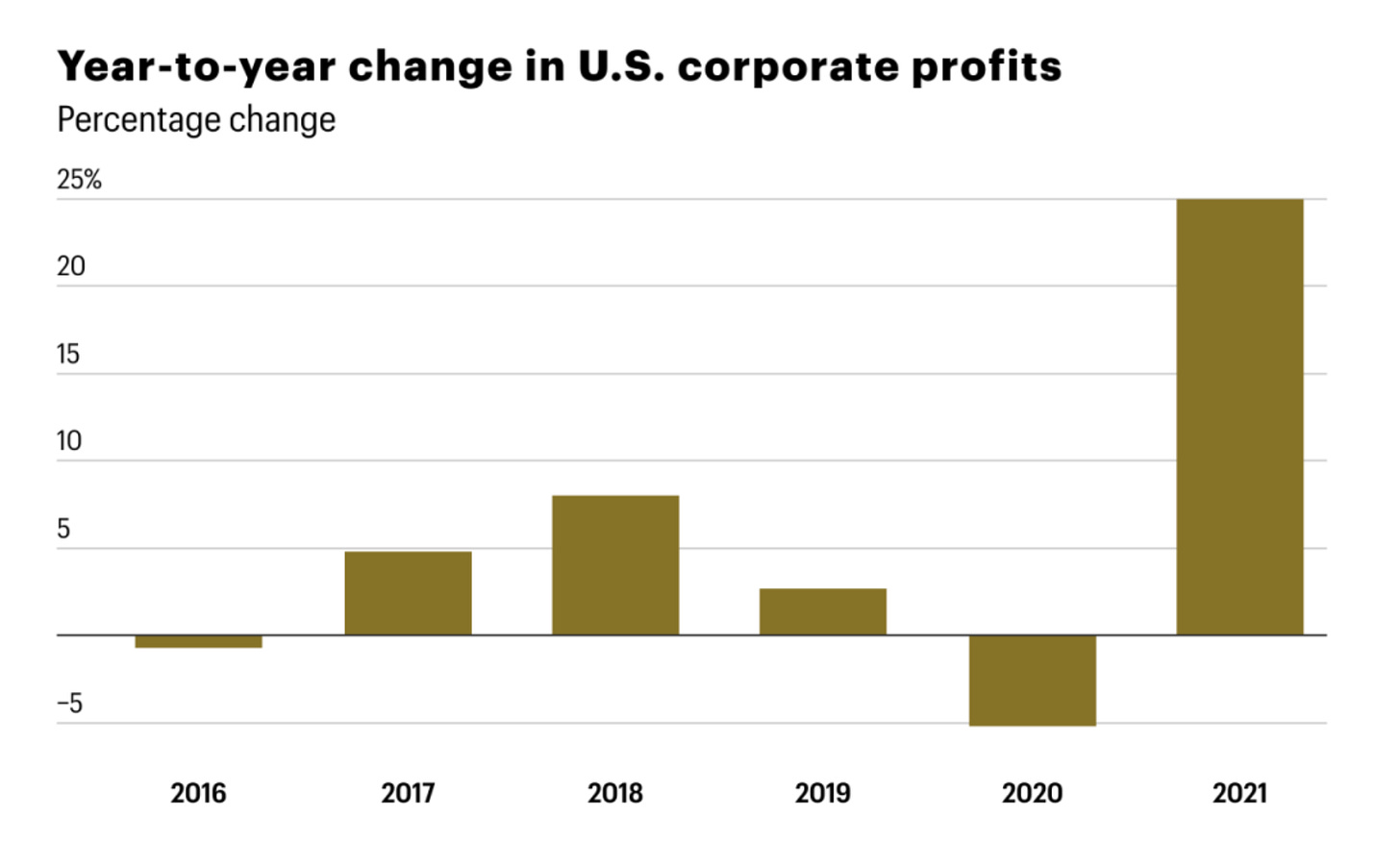

One could go on and on. One industry after the next cleaned up in the last few years, and top executives across the board cashed out as quickly as they could, in as many ways as they could. Sometimes this made a little sense (one at least gets why Pfizer had a great year), but Nike, Chevron, Steel Dynamics? Many firms jacked prices up to compensate for a variety of factors, including inflation, and overall corporate profits last year went up 37%, the highest in recorded history:

The moment the Fed slams on the brakes and accelerates any program of “quantitative tightening,” the pain will spread, as it always does, to the general population. Asset values will drop, pension funds will take it in the face, and all the things that we saw happen to innocent bystanders after 2008 will recur. Also just like 2008, the moment everything crashes, the predators left with cash on hand will scour the landscape, look for “babies thrown out with the bathwater,” as one finance-sector friend of mine put it, and go on a buying spree, again, as they did with mortgages after 2008. “That’s when they make the real money,” he said.

We already saw this in microcosm at the outset of the pandemic. You might recall billionaire investor Bill Ackman of Pershing Capital Management going on CNBC in the pre-bailout period of March 18, 2020 and literally weeping as he predicted, “Hell is coming!” and “America will end as we know it!” unless Donald Trump and Democratic counterparts approved a sweeping federal rescue program. Furious at the lack of action, Ackman told a story about how he, Bill Ackman, was already sacrificing, having already gone into self-lockdown, refusing to see even close relatives, because (pausing, sniffling) “I am not going to kill my father!”

A few days later, on March 25rd, 2020, when it became clear the CARES Act would indeed pass, Ackman sent a cheery letter to investors announcing that he’d not only made $2.6 billion shorting panicked markets, but that his Pershing fund had already begun the happy process of buying up stocks at “bargain” prices with the proceeds:

On March 23rd, we completed the exit of our hedges generating proceeds of $2.6 billion for the Pershing Square funds ($2.1 billion for PSH), compared with premiums paid and commissions totaling $27 million, which offset the mark-to-market losses in our equity portfolio. Our hedges were in the form of purchases of credit protection on various global investment grade and high yield credit indices…

For all of the above reasons, we became increasingly positive on equity and credit markets last week, and began the process of unwinding our hedges and redeploying our capital in companies we love at bargain prices that are built to withstand this crisis, and which we believe will flourish long term.

That happened in microcosm in 2020, and it’ll happen again when the “storm clouds” of 2022 turn into a real storm, which is expected sooner rather than later. The Democrats, in a decision that lays bare their admirable consistency in underestimating the public’s intelligence, are trying to pass off the ridiculous notion that inflation and other market disruptions are the fault of Vladimir Putin’s decision to invade Ukraine, and not due to the $4.7 trillion in central bank subsidies that 1%-ers have been gulping like Jell-o shots for over two years now.

This is not to say the Russian oil and agricultural disruptions have no effect on the economy. They’re more like additional unexpected complications piled atop a set of problems that were already both massive and “baked in the cake,” as Blankfein might put it. The larger issue is whom exactly the Bidens, Yellens, and Powells of the world represent.

As far back as 2016 (when both Bernie Sanders and Donald Trump put the Fed at the center of their campaign pitches), there’s been a growing sense among voters that national financial policy, and especially central bank policy, is dictated by the needs and desires of the very few.

As that friend of mine points out, the notion that the managers of monetary policy don’t serve ordinary people is not a new one. Once upon a time, such resentments fueled the populist campaign of William Jennings Bryan, who saw the push for a gold standard as a gambit to protect with “hard money” the wealth gains of those who owned financial assets (as opposed to those who did not), with Bryan saying famously, “You shall not crucify mankind upon a Cross of Gold.”

This time around, the belt-tightening measures that will be undertaken to crush inflation will of course protect ordinary people from the specter of $7 gallons of gas or other horrors. However, in the long run it’s the very wealthy who may have recent gains to protect who have the most to lose from this volatility, and it’s their interests the coming tightening will be designed to serve. Just like 2008, when piles of public treasure made gambling-addict banks whole again while individual savers and homeowners got wiped out and told to “suck it in and cope,” these post-2020 Fed policies made a handful of very big winners while gearing up to make losers of the rest.

Then and now, the pain will cut across geography and party. The wealth gap widened significantly after the 2008 bailouts and has already done so again in the pandemic period, when the bottom 99% worldwide is worse off than at the start of the emergency, and just those slivers of high society listed above saw jumps.

After 2008, there was intense propaganda to deflect public attention from the causes of the crash. The new emphasis will be on making sure culture-war issues prevent the losers in this latest bubble — be they millennial day-traders who became collateral damage to the crypto crash, or inner-city wage earners forced to watch their purchasing power wiped out via inflation — from realizing they may have shared antagonists in seats of financial power.

This is a constant in financial predation stories that’s virtually always ignored in the popular press, which insists on portraying blue and red America as separate worlds, whose citizens have nothing in common. That’s not just a lie, it’s really the core lie at the heart of our partisan political system. It’s why the notion of “economic anxiety” as even a partial factor behind Trump’s rise was so violently suppressed by press wizards in 2016, and why such extraordinary effort was put behind a propaganda campaign to wipe out the “Russian asset” Sanders.

Even Biden was scolded on MSNBC by Stephanie Ruhle when he tried once to suggest a “Scranton vs. Park Avenue” campaign theme. “Why is he going with this divide-and-conquer approach?” Ruhle cried. “What about a message for all Americans?” Unity, and “all Americans,” suddenly assumes enormous importance among professional division merchants once anyone starts talking not about red and blue, Trumpers and Dems, but few-versus-many.

Really we don’t live in two Americas but one, whose obvious problem is that too many of its citizens have too much in common, having been repeatedly ripped off, in the same types of scams, by the same people, for decades. Sooner or later, the public will figure it out, and come running toward Washington all at once, pitchforks drawn. All the Bidens of the world can hope for is that that day comes later. As the “Putin price hikes” idiocy shows, they’re running out of ways to stall the inevitable.

0 Comments