Up next on Wall Street’s exploitation list

Deplorables killed Net-Zero and ESG. I Know! Let’s Steal the National Parks!

by elizabeth nickson | Nov 19, 2023

Delayed but not stopped, the U.S. government is planning a rule that allows for America’s protected lands, including parks and wildlife refuges, to be listed on the N.Y. Stock Exchange. Natural Asset Companies (NACs) will be owned, managed, and traded by companies like BlackRock, Vanguard, and even China.

The deadline was Friday, but earlier this week, the deadline was postponed until January. This is the usual criminal feint from the environmental movement and the administrative state. People are complaining? Let’s put it off till they go back to sleep. Then we will steal their birthright late at night, in precisely the manner we have stolen everything else.

Since the early 2000’s, outfits like Goldman Sachs have been trying to trade air, or specifically carbon without much success. Their 2005 carbon exchange staggered along until it was quietly discontinued, and their Climate Exchange-Traded Fund (ETF) is now facing delisting. “ESG” was the next attempt to monetize the un-monetizable, with the “E” part of that acronym standing for Environment, ill-defined as that was. Now ESG is failing. Market leaders say it is facing “a perfect storm of negative sentiment” and its U.S. investments fell by $163 billion in the first quarter of 2023 alone.

Its stepchild, Net-Zero, is so loathed, it looks like it might blow up the entire carbon scam. Says Australian senator Matt Canavan, “Net-Zero has absolutely carked it. It is a soundbite and totally insane. Almost everything we grow, we make, we do in our society relies on the use of fossil fuels.” Vanguard has pulled out of Net-Zero funds. The British government too is backing out of Net-Zero, saying “we won’t save the planet by bankrupting the British people.” New Zealand’s new government revised the country’s Net-Zero plans in its first week in office. In the hard hit Netherlands, the Farmer-Citizen movement is now the dominant party in the Dutch senate and every provincial assembly. Sweden has abandoned its 100 percent Net-Zero plans and Norway has announced another $18 billion in oil and gas investments.

Even in the submissive E.U. voters are turning from the “green” parties toward anti-E.U. parties. Renewables funds are seeing massive outflows because of rising interest rates and declining subsidies. Of course, the massive subsidies taxpayers have already given both “renewables” investors and “renewables” companies will never be clawed back. All we will get is a shrug as they move onto the next kill. Which is so obvious it is a wonder no one predicted it.

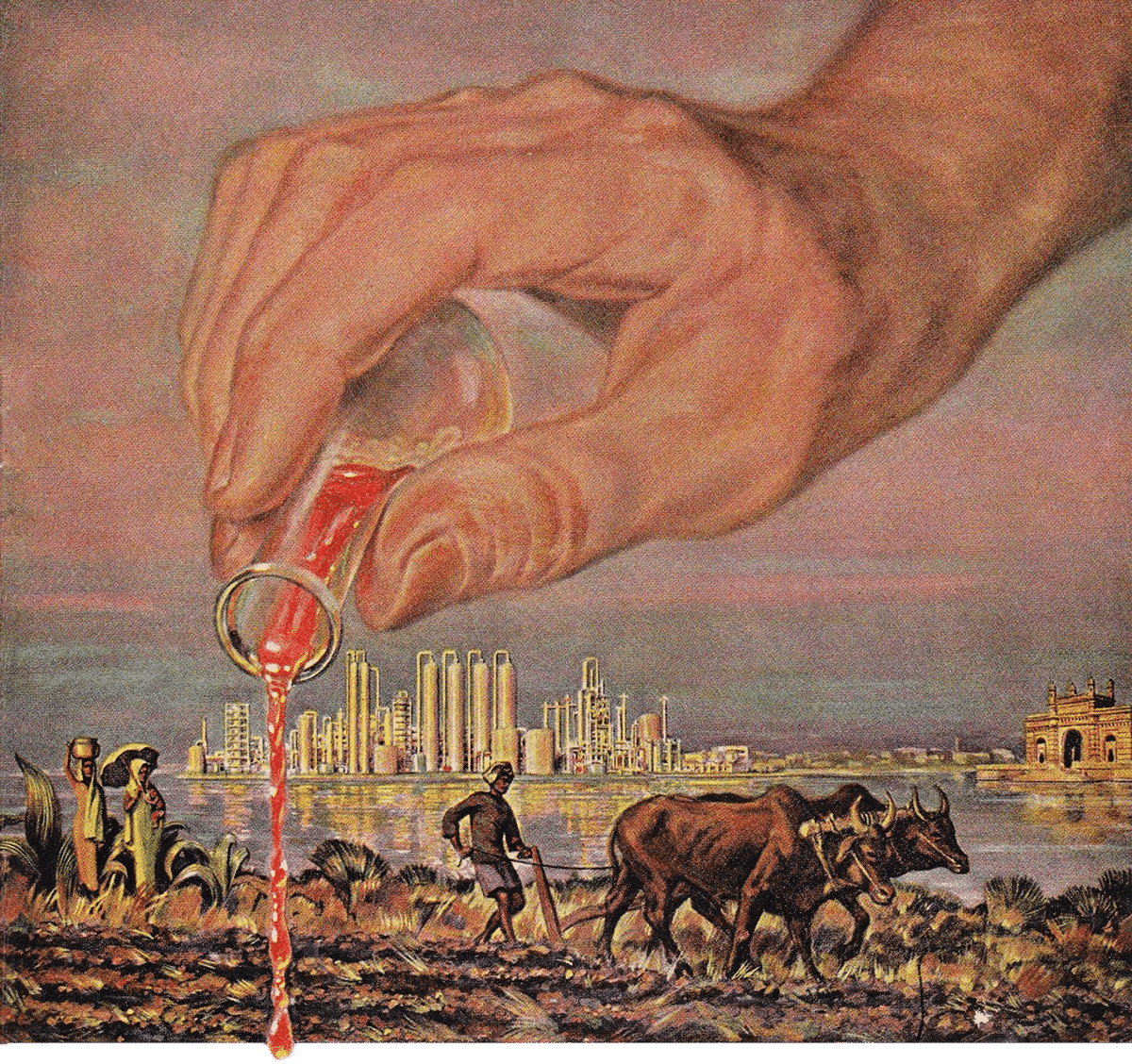

The entire universe envies the lush interior of the U.S. Increasingly empty, it is filled with a cornucopia of minerals, fiber, food, waters, extraordinarily fertile soil as well as well-ordered, educated, mostly docile people. Worth in the quadrillions, if one could monetize and trade it, financialize it, the way the market has financialized the future labor of Americans, well, it would be like golden coins raining from the sky.

On October 4th, the Securities and Exchange Commission filed a proposed rule to create Natural Asset Companies (NACs). A twenty-one day comment period was allowed, which is half the minimum number of days generally required and when they postponed passing the rule, they did not extend the comment period. “Nope, shut up,” they said.

NACs will allow BlackRock, Bill Gates, and possibly even China to hold the ecosystem rights to the land, water, air, and natural processes of the properties enrolled in NACs. Each NAC will hold “management authority” over the land. When we are issued carbon allowances, owners of said lands will be able to claim tax deductions and will be able to sell carbon allowances to businesses, families and townships. In the simplest of terms, that’s where the money will be made. WE peons will be renting air from the richest people on earth.

The following are eligible for NACs: National Parks, National Wildlife Refuges, Wilderness Areas, Areas of Critical Environmental Concern, Conservation Areas on Private and Federal Lands, Endangered Species Critical Habitat, and the Conservation Reserve Program. Lest you think that any conserved land is conserved in your name, the largest Conservation organization in the U.S., is called The Nature Conservancy, or TNC, which, while being a 501(c)3, also holds six billion dollars of land on its books. Those lands have been taken using your money via donations and government grants, and transferred to the Nature Conservancy, which can do with those lands what it wills.

If this rule passes, America’s conserved lands and parks will move onto the balance sheets of the richest people in the world. Management of those lands will be decided by them and their operations, to say the least, will be opaque.

μολὼν λαβέ, buddy.

Farm country is fighting back. American Stewards of Liberty, Committee for a Constructive Tomorrow, Kansas Natural Resource Coalition, Financial Fairness Alliance and Blue Ribbon Coalition have filed comments, Republican senators Pete Ricketts, James Risch and Mike Crapo have sent pointed queries to the SEC. This week, Rep. Harriet Hageman (R-WY) offered an amendment that would defund the SEC proposed rule to approve listing “NACs.”

Most of us ill-understand “financialization.” It is a complex set of maneuvers best explained by the behavior that crashed the economy in 2008 which bundled up questionable mortgages and brokered off the risk to dozens of different funds in order to share that risk. NACs are asset grabs. From ’09-’20, funds asset-stripped America’s manufacturing via debt obligations, buying the company, selling off the equipment, firing the most expensive employees, and gutting, if they could, pension funds. Then they upped the price and sold on the assets. Which were bundled and brokered off. These are called collateralized debt obligations and they thunder doom underneath the debt-fueled economy.

Natural Asset Companies are an attempt to grab hard assets to make up for an inevitable collapse. But taking more land out of production makes it certain that collapse moves ever closer. Land needs to be used, cared for, and maintained by the people who live on and use the land. Otherwise, it runs to desert and invasive species. The mad push to “green” and net-zero has triggered financialization, or a brokering of the future, because only energy spurs real growth — and energy has been increasingly restricted over the past twenty years. NACs are another destroyer of America’s heartland.

AmericanStewards.us is running the campaign against it, and you can find ways to help on their site.

0 Comments