Israel-Hamas and the Great Reset

by Najm Al-Dīn | Jan 8, 2023

With a spineless Arab leadership leaving Palestinians adrift at a critical period and negotiations to resolve the Israel-Hamas conflict reaching yet another impasse, it’s tempting to celebrate the Houthi attacks on Israel-bound shipments as heroic acts of resistance in solidarity with the occupied Palestinians.

While I understand why many would support the Yemeni rebel group operating on the fringes of the Israel-Hamas war, an important dynamic to this latest flare-up has been overlooked.

The ripples in the Red Sea from this recent cycle of hostility follow a consistent pattern, where the world’s economic and political systems are being radically restructured by unelected globalist entities such as the WEF (World Economic Forum).

Simply, one cannot view this regional spillover in isolation to the seismic geopolitical and economic shifts which have transpired over the past four years.

Sustainable Development Goals

On reflection, every major geopolitical development since 2020 has advanced the WEF’s Great Reset, commonly referred to as the UN 2030 SDGs (Sustainable Development Goals).

The SDGs are 17 targets for global development adopted by 193 UN member states at the Sustainable Development Summit in 2015.

They provide a blueprint for a sustainable future, promising transformative changes in areas like biodiversity loss, healthcare, poverty and climate change. All countries have agreed to work towards achieving them by 2030.

At face value, the SDGs are a welcome initiative, addressing pressing humanitarian and ecological concerns. However, the deeper we probe, we see the contours of a highly predatory and exploitative economic system which will be built on the ashes of the current economy.

Circular economy

A cornerstone of the SDGs is to significantly reduce carbon emissions through the phasing out of fossil fuels. This entails upending industrial economies and replacing them with a circular economy which will dramatically alter the models of international governance, forms of commerce and types of labour, leading to new business models and norms.

Under a circular economy, the public will be railroaded into a stratified economic order consisting of a two tiered class system of owners and renters, where products are rendered as services for more sustainable levels of consumption. Its proponents at the World Economic Forum view it as an essential path for boosting global sustainable ecosystems as it will encourage people to abandon the linear value model of consumption and wastage which has become the hallmark of capitalist economies.

However, reimagining ownership models will empower asset managers, as corporations possess the financial means to own and maintain products throughout life cycles while consumers shift from owning materials to sharing, renting, reusing and recycling them to achieve carbon neutrality.

This resource-efficient economy cedes sovereignty of the global commons to conglomerates whilst depriving the public of ownership rights, as investment giants like BlackRock and Vanguard hoover up tangible assets in their new role as service providers.

National Sovereignty

With governments struggling to meet net zero targets, the private capital required to plug the shortfall and implement the SDGs will grant non-state actors a disproportionate influence over the fiscal policy of nation states.

As the separation between private sectors and elected governments erode, the implications for national sovereignty looks ominous.

To make it palatable to the public, hedge funds are packaging this oligarchic coup as ‘stakeholder capitalism,’ where private corporations become de facto trustees of society, addressing the world’s economic and environmental challenges by controlling the means of production, distribution and ownership and exercising significant influence over international markets and state policies.

As stakeholder capitalism is underpinned by a transition to renewable energy and materials, powerful hedge funds have decided to disinvest in fossil fuels and redirect their capital towards companies whose business models are compatible with the SDGs.

Without mandate, a global public-private partnership headed by central banks and billionaire philanthropic foundations decided to reimagine our world through a ‘new normal’, where a multi-stakeholder model of global governance enriches the architects of the SDGs through the greatest transfer of wealth and accretion of power in modern times.

So how do tensions in the Red Sea advance this capitalist makeover?

To answer this question, we must revisit global events preceding this conflict which have accelerated the SDGs.

Pandemic

The pandemic was the opening salvo which altered global energy demand and shifted consumer habits.

According to Klaus Schwab, the founder and charman of the WEF, lockdowns were a catalyst for the Fourth Industrial Revolution. Technocrats made no secret of the transformative opportunity to be leveraged from the crisis, which encouraged greener employment patterns by outsourcing labour to automation and AI systems.

With carbon-intensive fuels like coal and oil bearing the brunt of demand reduction caused by lockdowns, sustainability became embedded into strategies to kick-start economies, with many drawing comparisons between efforts to mitigate COVID-19 and those required to reduce emissions.

Ukraine

Two years after the pandemic, the Ukraine war led to unprecedented volatility in global food prices, whilst EU import bans on Russia’s oil and gas became another impetus for reducing reliance on fossil fuels and transitioning to green energy.

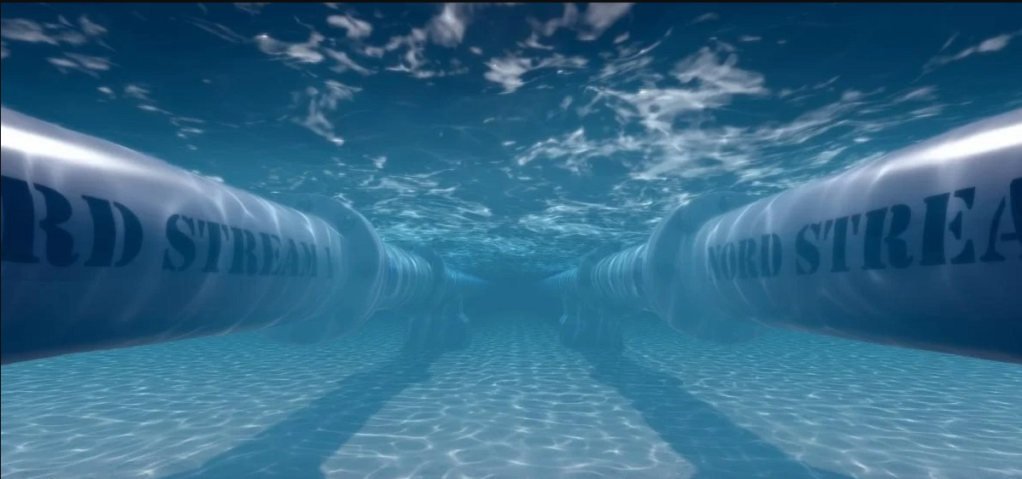

After disrupting the energy market, triggering a global cost of living crisis and renewing interest in ‘sustainable’ proteins such as lab-grown meat, the sabotage of Nordstream pipelines conveniently ruptured European-Russian energy relations, reinforcing the centrality of renewable energy in any economic recovery.

Red Sea

The world is now undergoing what I believe is the latest phase in the globalist experiment to push the SDGs, which entails turbulence in the Middle East to cover for long term economic transitions.

The Israel-Hamas conflict has reached the Red Sea, a vital economic artery for the free flow of international trade. With the Suez Canal at its northern end and Bab el-Mandeb Strait at the south leading into the Gulf of Aden, the sabotage of shipments in this Eurasian maritime passage will have global economic implications.

As other freight firms join international shipping containers like Maersk and oil giants BP to reroute around the Cape of Good Hope, the increasing costs of fuel and insurance premiums will be passed onto domestic energy consumers, while vessel owners profit from supply chain bottlenecks.

While the US has struggled to get the likes of Saudi Arabia and UAE to join its naval alliance to deter Houthi attacks, targeted strikes on Houthi drone factories and an embargo on incoming ships will likely lead to Houthi strikes on Saudi and UAE oil production. It is unlikely that Iran can stand on the sidelines for too long in this escalating scenario, seeing as it is the main supplier of Houthi missiles and drones. Therefore, tensions involving energy exporting nations like Iran and the Gulf Sheikhdoms can also extend to the Strait of Hormuz, the world’s most important oil passageway, which feuding parties may try to leverage through sanctions and disruption to maritime trade.

Further blockades in the Red Sea will inevitably imperil Egypt’s economy, given its reliance on Suez Canal transit fees as a source of revenue. Already running low on foreign currency and reeling from inflation, long term disruption to Red Sea traffic can potentially fuel social unrest in the country.

Tit-for-tat attacks on cargo vessels in these strategic chokepoints will induce yet another energy crunch, upend global supply chains, compound the cost of living crisis and heighten inflationary pressures.

Just like the pandemic and Ukraine invasion, the wider economic implications stemming from the Israel-Hamas conflict is shaping up to be yet another war on conventional energy sources and dovetails with the SDGs, as the interruption to energy supplies could coerce nations to scale back energy-intensive industries and inaugurate an era of “green” austerity.

This will centralise power in the hands of stakeholder capitalists who can impose draconian controls on public expenditures through carbon footprint trackers, carbon credits via programmable Central Bank Digital Currencies (CBDCs) and diminish ownership rights in a neo-feudal circular economy, where you will own nothing and be happy.

New Middle East

However, hastening the march to net zero is not the only outcome I envisage from the wider fallout in this Israel-Hamas war.

It may have eluded readers that the economic repercussions of Houthi attacks may alter the trajectory of geopolitical power in Israel’s favour by encouraging the building of alternate trade corridors via Israel.

Netanyahu recently declared at a UN General Assembly meeting that in collaboration with Arab neighbours, Israel was on the cusp of a historical transformation, forming the heart of a new trading axis connecting Asia to Europe, known as the India-Middle East-Europe-Economic Corridor (IMEC).

This ‘New Middle East’ can convert Israel into a highly strategic outpost connecting the Indian Ocean and the Mediterranean Sea, marking Tel Aviv’s arrival on the scramble for Eurasia and breaking Egypt’s monopoly over transcontinental trade routes.

Some analysts have also speculated about the genocide being a prelude to the construction of an alternative maritime route known as the Ben Gurion Canal (BGC) which connects the Southern Israeli port of Eilat to the Mediterranean through Gaza, giving Israel access to natural gas in the Levant basin.

By annexing the coastal enclave, Zionists can acquire control over the offshore gas and petroleum in the Gaza marine field, which will expedite the corridor of prosperity. Its successful completion will also grant NATO vessels an alternate transport passage should future problems arise with accessing the Suez Canal, thus depriving Egypt of any leverage over Israel if tensions emerge from a regional spillover.

While I cannot see the BGC coming to fruition anytime soon given the huge logistical and political challenges involved in its creation, it can open passages for travel in opposite directions, offer faster navigation than the Suez and avoid a backlog of ships which we saw recently when a vessel’s bow got lodged in the eastern bank of the Suez resulting in the blockage of transit.

With the Israeli Ministry of Environment targeting 40% of renewables by 2030, highlighting its commitment to the SDGs, regions like Khan Younis in the southern Gaza strip can also become a green energy hub, having already been earmarked as a sustainable future ‘smart city‘. Therefore, Gaza may be ground zero for tech entrepreneurs like Elon Musk to ‘Build Back Better’ with data-driven eco-friendly urban centres controlled by cloud computing technologies.

Multipolarity

It’s worth noting that many years before the pandemic, the World Economic Forum opined that by 2030, the international rules based order would be reimagined with America no longer the global hegemon par excellence.

Given Washington’s receding strategic footprint on the world stage and the emergence of new power blocs such as BRICS as major drivers of global trade and investment, the return to multipolarity looks increasingly likely.

Depending on how the geopolitics of the Middle East unfolds, a large concentration of financial and technological power could be converging in Tel Aviv.

Already a tech powerhouse playing a pioneering role in the WEF’s Fourth Industrial Revolution, Israel’s ambitious economic corridor may become the world’s most geostrategic shipping lane when the globe is reeling from a supply crunch.

Therefore, in the redistribution and realignment of global power and transition of the rules based order as envisaged by the WEF, Israel may be catapulted to international prominence, inching closer to the clover leaf world centred on Jerusalem

Like many of you, I find Israel’s genocide of Gaza to be unconscionable. However, I must caution the Pro-Palestinian and BDS movement from being too excitable over the Houthi attacks on Israel-affiliated merchant vessels.

It’s time for us to be more eagle-eyed and alert to the stealthy moves on the geopolitical chessboard which facilitate long-term strategic visions of disaster capitalists who want a critical mass on board with the UN 2030 SDGs.

0 Comments